This was officially announced by the Ministry of Digital Transformation of Ukraine, referring to the results of a study published by Chainalysis. But there is a small issue - a brief summary was taken from the future report, which has not yet been published.

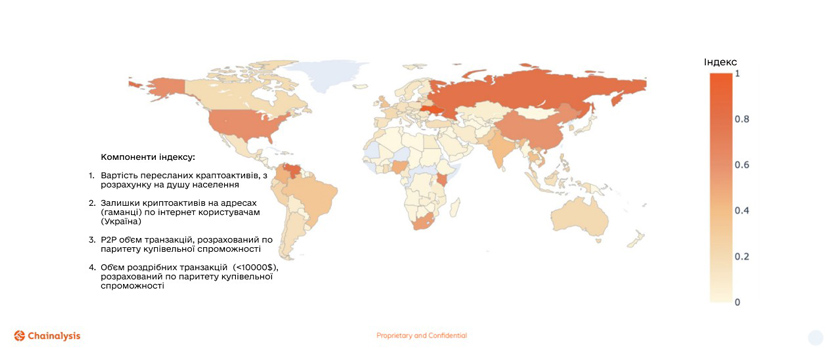

It is known, however, that the index is calculated based on several key parameters. These include:

- Value of assets transferred per capita.

- The remaining amount of coins on accounts.

- The number of retail and peer-to-peer transfers exceeding 10 thousand USD, calculated based on the purchasing power parity of the population

Of course, this information was presented as another "sensational breakthrough" of the Ukrainian economy. Even if the final data are slightly different from the preliminary ones, the country will still be in the top 5 of the world ranking in terms of the volume of digital payments.

However, describing the reasons for this phenomenon, in addition to a really large community of blockchain developers, good digital literacy of the population and the growth of the intermediation sector on world marketplaces, officials for some reason do not mention the main ones: the devaluation of the national currency, a complete loss of trust in banks, the lack of full-fledged regulation with a side of the state and an excellent opportunity to evade taxes.

Yes, in a small business there are a lot of competent specialists who understand the main aspects of using a cryptocurrency. Simply because there are no normal digital money transfers in the country without a large commission. If suddenly someone does not remember, the PayPal system is still promised to be launched in Ukraine, and WebMoney was blocked after the events of 2014. The using of cryptocurrency for settlements with foreign partners is also facilitated by rather strict restrictions regarding the foreign economic activity. Which are often overwhelming for small and medium businesses.

Yes, many ordinary citizens have mastered mining, staking and speculation in the cryptocurrency market, but only because this is at least some kind of guaranteed income, and it is not (yet) taxed.

Yes, Ukrainians keep their savings in cryptocurrency, but only because they remember how difficult it was to withdraw money after 2014 and how quickly all dollars disappeared from currency exchangers. And the usual way of investing - in real estate, has become much less convenient both due to a general decline in purchasing power and due to a catastrophic rise in prices.

Simply put, the citizens of Ukraine have mastered the use of cryptocurrency so well not due to the activities of the state - like the Ministry of Digital Transformation, but in spite of it. And whether the new draft law “On virtual assets”, which the Verkhovna Rada (Ukrainian Government) will consider in September, will affect the situation is a big question.

An important point - according to the same preliminary data, a similar picture is observed in other countries whose economies cannot boast of stability - Venezuela, Kenya, South Africa and Nigeria. But also in China and the USA. Therefore, whether the leading position in this rating could be not so positive factor.

In addition, other experts who also worked with information from Chainalysis have some questions about the calculation methodology. More details can be answered only after the official release. Nevertheless, there is no reason not to trust her - Chainalysis is known all over the world for fairly accurate coverage of situations related to various aspects of the cryptocurrency using.

Published on the EXBASE based on materials from forklog.com